how much taxes are taken out of a paycheck in ky

The IRS has already sent out more than 156 million third stimulus checks worth approximately 372 billion. Now you claim dependents on the new Form W-4.

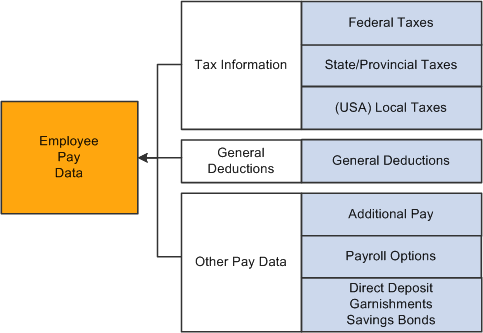

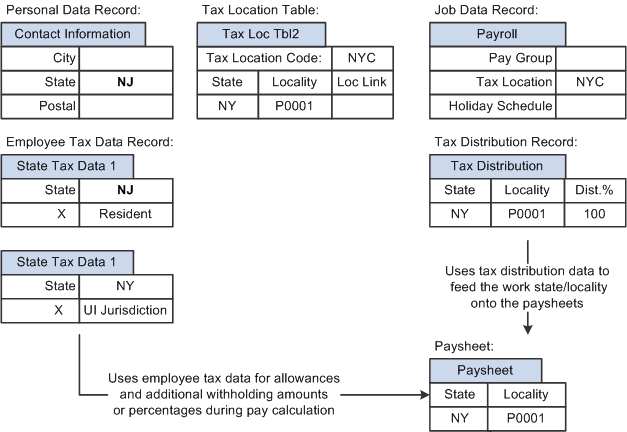

Peoplesoft Payroll For North America 9 1 Peoplebook

So the tax year 2022 will start from July 01 2021 to June 30 2022.

. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary. Our calculator has recently been updated to include both the latest Federal Tax. Government spent nearly 4.

The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. Thanks to Kentuckys system of local occupational taxes there are no local sales tax rates throughout the state.

How Much Tax Is Deducted From A Paycheck In Ky. How much you pay in federal income taxes depends on the information you filled out on your Form W-4. Solved Kentucky imposes a flat income tax of 5.

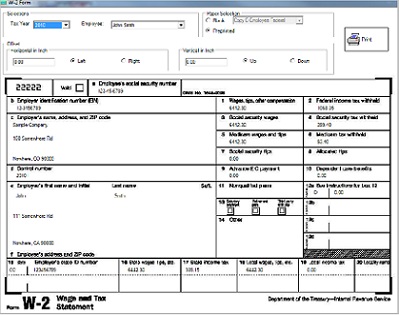

Whenever you get paid regardless of which state you call home your employer will. A pay table tells you the way much the equipment pays every payable selection. W4 Employee Withholding Certificate The IRS has changed the withholding rules.

Until 2020 you could reduce the amount of taxes. If your employees contribute to HSA 401k or other pre-tax withholdings deduct the appropriate amount from their gross pay before you. Calculate Any Pre-Tax Withholdings.

Kentucky Tax Brackets for Tax Year. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. That means that the states sales tax rate of 6 is the only.

How much tax is taken out of a 200 paycheck in Kentucky please let me know. Kentucky Salary Paycheck Calculator. The tax rate is the same no matter what filing status you use.

The landlady flat-out said no. Because tax bills have been delayed into 2022 she says she and her. The number of semis that usually travel my stretch of highway is about a 13 of normal capacity.

How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. Property taxes in South Carolina remain low. The Kentucky paycheck calculator will calculate the amount of taxes taken out of your paycheck.

Pressure off the edge. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. In the 1000 bonus example 1000 x 125 1250.

Fast easy accurate payroll and tax so you can. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

This is the form that tells your employer how. How Your Kentucky Paycheck Works. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

Kentucky Payroll Tools Tax Rates And Resources Paycheckcity

How Much In Federal Taxes Is Taken Out Of Paychecks

2022 Federal State Payroll Tax Rates For Employers

Kentucky Paycheck Calculator Tax Year 2022

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

State W 4 Form Detailed Withholding Forms By State Chart

Paycheck Taxes Federal State Local Withholding H R Block

Payroll Software Solution For Kentucky Small Business

Peoplesoft Payroll For North America 9 1 Peoplebook

State Individual Income Tax Rates And Brackets Tax Foundation

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

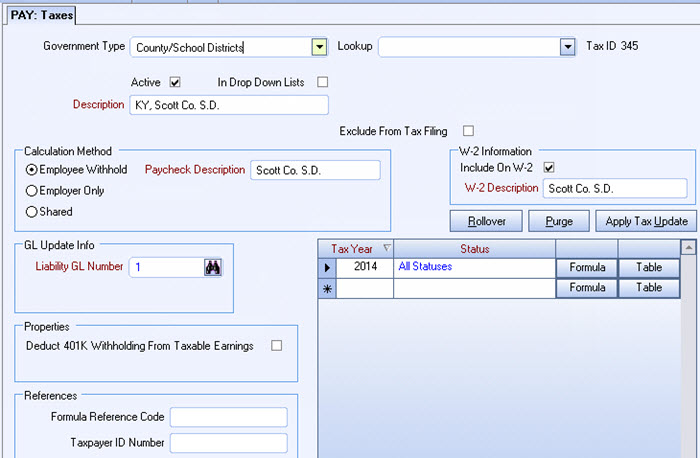

Kentucky County School District Taxes

Payroll Software Solution For Kentucky Small Business

Kentucky Estate Tax Everything You Need To Know Smartasset

How To Do Payroll In Kentucky What Employers Need To Know

Computer Payroll Software Ezpaycheck Updated For Kentucky Small Business

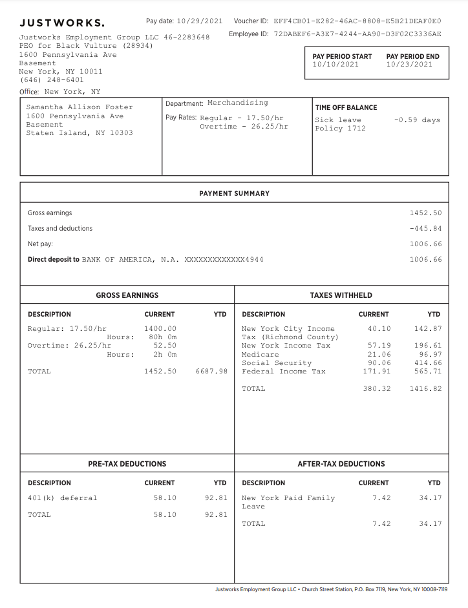

Questions About My Paycheck Justworks Help Center

Hb 8 Will Hurt Ky By Shifting Tax Burden From Rich To Poor Lexington Herald Leader